The rapid development of the local automotive industry has been achieved by continuous improvement of local car brands. At the same time, consumers are increasingly familiar with types of cars – and even auto parts. For friction materials, consumers are not only concerned about the basic performance such as braking safety and brake pad life, but also comfort requirements such as noise, judder, pedal feel, etc. Some car makers are even demanding extremely strict zero noise requirements.

A series of dynamometer tests (including friction efficiency, NVH, DTV, MPU, AMS and stiction) must be passed in early brake pad development stages. During later field tests, many parameters will be tested again one by one. Besides some closed road test sites, the Huangshan open road test site (which is very similar to Mojacar in Spain) is favoured and recognized by car makers, brake system makers and brake pad producers alike. The testing route includes mountain roads, high-speed sections and urban roads, and it can be used to evaluate specific requirements like creep groan, squeal and judder.

Friction products are at the end of the supply chain, and friction material formulation is relatively easy to change. It is therefore possible to adapt it during the road test stage if problems are found in parameters like MPU, Stiction and NVH in either the friction product itself or the brake system. In addition, friction producers are faced with repeated development and verification, because the correlation between early stage friction material development and later field testing is limited. It is also difficult for friction producers to evaluate up front how well friction material formulation matches vehicle model. For example, low-frequency noise is difficult to detect during dynamometer testing, but it often occurs in the real vehicle road test.

With people’s enhanced requirements for brake comfort, the formulation style of friction materials has changed from low-metal to predominately NAO. Only very limited low-end models and some models with large inertia from local brands will choose low-metal formulations. Japanese and South Korean brand cars mainly use NAO. European middle and low-end models use NAO, while high-end models stay with low-metal formulations. The wide application of NAO has made stiction issues and poor rotor cleanability evident. This is still a major problem that friction producers need to solve.

Governments are also increasingly demanding improved environmental performance. Asbestos has been forbidden in the PCDP market for a long time. Because of copper-free regulations in the United States, the whole world has started making copper free brake pads. In China, some car makers have started mass production using copper free brake pads, and this will continue in new projects. Although the copper-free formulation has not yet been widely implemented it is an important trend, and this R&D focus has over the past few years been the main task for friction producers. Without the high-quality and unique characteristics of copper fibres (reinforcement, thermal conductivity and wear resistance) issues like judder, wear, high and low frequency noise all come up. Copper-free formulations are essential for environmental and health & safety reasons. There are still many challenges in the research and application process, but we believe that copper-free friction materials will become more and more mature.

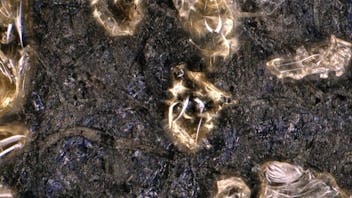

As a leading mineral fibre producer for the friction industry worldwide, Lapinus has thoroughly researched sustainable mineral fibres for copper-free formulations. Complying with the increased focus on health & safety and the environment, all Lapinus products are certified bio-soluble. That means they are proven to be safe to humans.

The Chinese OE market is clearly unique. The technical requirements are not only extensive but also to a very high standard. And at the lowest possible cost levels.